Ben Luthi are an award-profitable personal loans writer who focuses primarily on credit cards, rewards software, and you can mortgages. He first started their composing career at NerdWallet covering credit cards and you can writing on figuratively speaking on Student loan Hero, just before are a full-go out freelancer.

Glen Luke Flanagan is a good deputy editor during the Fortune Suggests just who targets financial and you will mastercard content. His earlier in the day roles include deputy publisher positions at Us Now Blueprint and you may Forbes Mentor, in addition to senior publisher from the LendingTree-every focused on bank card perks, fico scores, and you can relevant information.

When purchasing property, it is essential to think ways you can lower your mortgage’s notice price, including doing your research, and then make a massive down-payment, and you can enhancing your credit score. You to alternative that needs to be on the radar try to invest in mortgage items, referred to as dismiss items, once you personal on financial. When you’re ready buying property, here is what you must know about how home loan situations works-to determine if these are typically effectively for you.

What are home loan circumstances?

Mortgage things was a kind of prepaid attention to use to effortlessly purchase off your residence loan’s rate of interest. Each point will set you back 1% of one’s amount borrowed and will usually reduce your interest rate by 0.25% (though this will are very different by bank).

These home loan situations are paid back to the lending company on closure, always by homebuyer. Yet not, it could be you can in order to discuss to have the vendor spend buying on the loan’s interest, particularly in a client’s market in which sellers have less away from an enthusiastic advantage.

Discount affairs versus. origination factors

Yet another home loan section you may discover try origination circumstances, which you’ll pay to the lender to cover price of originating the mortgage-in addition to operating your application and you can files and you will closing the transaction.

Including disregard circumstances, for every origination section means 1% of your loan amount. not, whilst you might possibly negotiate straight down origination charges, these are generally basically perhaps not recommended for example discount items.

When you take away a mortgage or refinancing a preexisting financing, you must buy dismiss products within closure-there isn’t any solution to pick down your own rate of interest up coming in the place of refinancing the loan.

It is essential to mention, but not, you to definitely running the cost with the financing will increase the loan number, that may lower your possible savings.

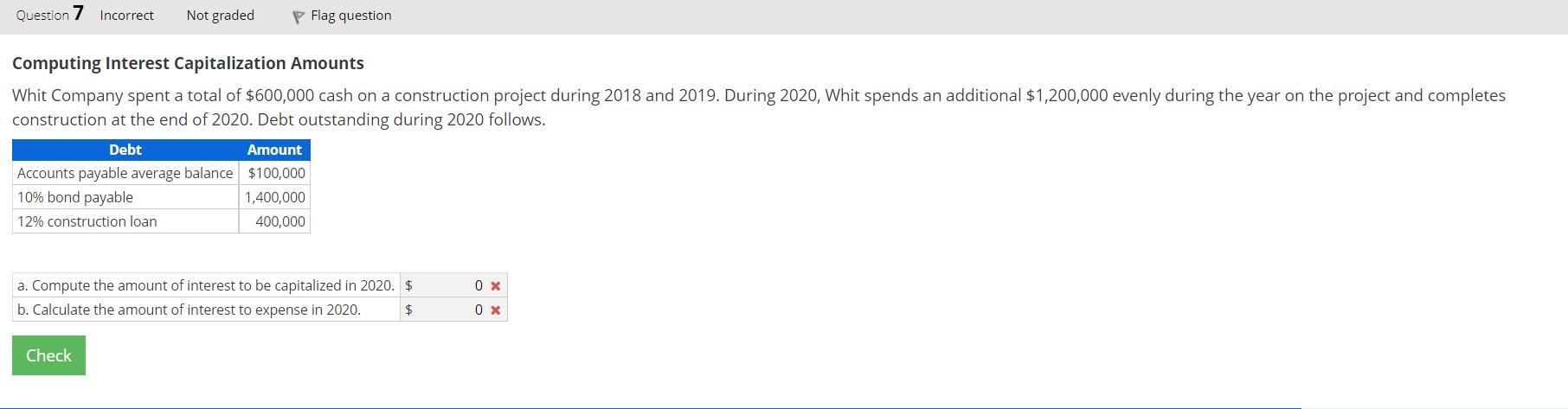

Home loan affairs example

Investing step 1% of one’s amount borrowed to have a beneficial 0.25% interest rate avoidance will most likely not appear to be much on the the exterior. But depending on how enough time you plan to hang on the loan, this may potentially save you thousands of dollars on the a lot of time focus on.

online payday loans North Carolina

Such as for example, what if you plan to take out a $400,000 repaired-rates home loan with a beneficial six.5% rate of interest and you may a 30-season repayment label. If you decided to get one financial part getting $cuatro,000, a 0.25% protection form the financial institution would lose the price so you can six.25%.

Listed below are quotes away from the one or two solutions do evaluate if the you’re to hang the borrowed funds with the full three decades:

If you find yourself you’ll be able to however spend less of the going the cost of the fresh items towards financing, possible optimize your offers by paying to them in the closing.

Pros and cons out-of home loan items

Before you pay money for dismiss circumstances, it is very important consider each other the advantages and disadvantages, especially in how they relate with your unique problem. Here are a few what to remember.

- All the way down monthly premiums. In case the priority is to minimize their payment, expenses some cash initial will be worth every penny it doesn’t matter if your break-even eventually.