There are various benefits to paying down their financial very early, if you are about fortunate position so that you can think this. The key question, however, are in the event that you?

Right here, we’ve got game within the advantages and disadvantages away from paying off the complete financial obligation in advance of its due to assist make you a far greater tip from whether to proceed involved.

The benefits of early payment

Whether you are a robust earner, cautious saver, otherwise possess maybe received a large heredity, you may be tempted to pay back your mortgage prior to when might to start with organized.

Debt-free living

Though their mortgage is not your own merely loans, it does positively become your biggest, in the vast majority out-of circumstances. Releasing yourself out of this level of investment decision you may, for this reason, getting very helpful into total issues. It’s also possible to manage to improve your works-existence equilibrium without any weight out of month-to-month money to worry about.

In addition, the other bucks you can take back each month could be used with the a great deal more fun expenses, like travelling, or luxury stuff you won’t if not features provided.

Reduces the overall desire you pay

With respect to the style of and measurements of home loan you’ve got, the degree of notice payable per month will disagree more. However,, regardless of whether you’re paying down towards the an interest-simply or installment base, the brand new extended your own mortgage identity persists, the greater focus possible pay-off full.

Paying their mortgage actually a few years prior to when anticipated could save you thousands of pounds inside notice, although not, it is vital to become certain of their financial conditions and terms one which just agree to these choice.

Your house will be your individual

After you have repaid your own financial entirely, your home is your own to do with as you come across complement, so repaying very early implies that you can enjoy the autonomy from the sooner rather than later. You can easily not getting bound by people restrictive conditions, and can love to sell, rent, or even share your property so you’re able to family unit members, if you want to exercise.

What’s the catch?

Whether you’re able to pay your home loan very early, and you can whether or not you really need to, depends upon individual activities, and far like any high monetary decision, there are both advantages and disadvantages.

Early Fees Fees (ERCs)

The vast majority of mortgages get both early repayment charge, log off charges, or each other. Your own financial calculated credit predicated on them accruing a certain peak of cash from your own desire payments. If you pay back the loan early, such percentage assists them in order to claw right back several of the expenses that they may overlook, if you stop spending them notice prior to when it expected.

ERCs may differ considerably based on how very early you opt to pay therefore the size of the loan. The brand new next by the end of one’s home loan title youre, not, the reduced the charge could be. However, that it contour you are going to nevertheless be easily numerous thousands of pounds, so it’s vital that you weigh the cost of that it from the coupons you’d generate away from settling early.

Overlooked appeal and you can/otherwise taxation advantages

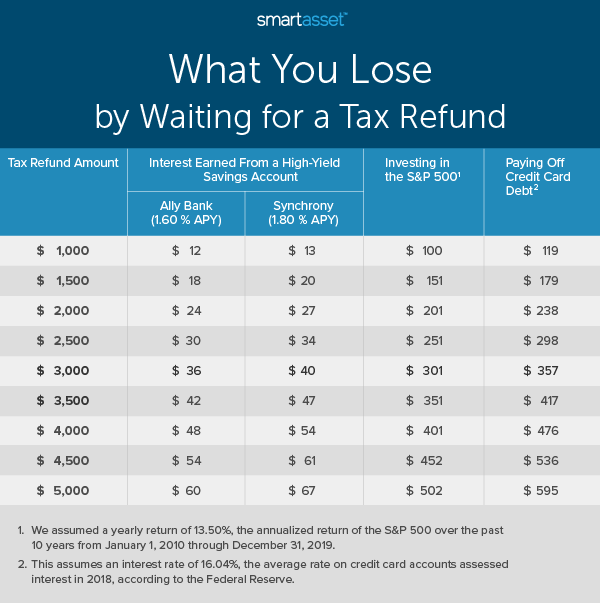

If you are intending to use the discounts to repay the balance in your home loan, it’s really worth considering that if the interest you happen to be currently accruing on your offers are greater than the amount you are paying on your mortgage, you could achieve higher positives by leaving the brand new deals in which it is for the present time.

Based on your actual age plus the state of newest retirement pot, it may become more best for lead the savings finance towards your pension, unlike paying down your own mortgage using them. Oftentimes, new income tax benefits associated with performing this would surpass any attention offers you’ll build.

Maybe not prioritising the higher interest borrowing

When your mortgage is not your own only debt, there is certainly a high probability that your most other expense are increasingly being paid back at the highest interest levels. Even though the mortgage interest levels have risen considerably previously seasons, it remain significantly less than of a lot un-secured debts like once the handmade cards and you will car finance, in the majority of times.

Hence, repaying reduced expense having highest interest levels can be more useful eventually. Shortly after speaking of paid down, you’ll have extra cash offered per month in order to join paying off their home loan, that will remain able to do so very early.

How will you repay my personal mortgage very early?

If you have had a giant windfall, it’s possible to pay off the entire financing with a single lump sum. Be aware that this can happen fees, but unless of course this type of fees is more than the cost of the latest leftover focus repayments, it has been the most basic and more than affordable means to fix finalise their mortgage early.

Just how remortgaging may help

Whilst you wouldn’t be instantaneously financial-100 % free, remortgaging so you’re able to a product or service with an increase of flexible www.availableloan.net/payday-loans-ca/san-diego terms and conditions could help you to settle their the balance easier. In case the latest mortgage lender will not offer the following possibilities, it may be worth taking into consideration remortgaging to the capability to:

Of several progressive home loan items give you the option to overpay the same from ten% of one’s overall loan amount per year, on top of the basic monthly repayments, in place of incurring people costs otherwise charges. This gives you the opportunity to end settling earlier than suggested, as the to stop ERCs.

A counterbalance home loan concerns carrying your own checking account with similar lender that provide the home loan. This enables them to counterbalance your own offers balance from the financial attract. Reduced attention means a heightened part of the monthly money wade towards the reducing the home loan harmony, enabling you to pay it back more quickly.

You’ll find costs associated with remortgaging, thus even when here is the correct selection for you, often once again, believe your personal facts, including how much cash you have got leftover on the home loan balance. A talented broker should be able to help you weigh it contrary to the other available choices out there, and help your dictate how to reach finally your early cost goals.