- A guide to remortgaging your home

- Business and you can licensing

- A guide to remortgaging your property

The basics of remortgaging your house

A good remortgage otherwise remortgaging’ means obtaining an alternative mortgage, always that have greatest words and regularly on the choice to use money on finest of current financial. This could consider your residence, such as for example a domestic home loan if not the commercial assets such since a store, office or store.

With many mortgage business lasting 5, ten, 20 or thirty-five decades, it is rather likely that you will possibly not getting acquiring the finest rates because the a citizen otherwise homeowner.

If you purchased a fixed rate mortgage otherwise was indeed accepted on the basis of your revenue and you will credit score on time of the application, you may find that you’re eligible for more favourable terms and conditions and will create a serious saving monthly and seasons.

Particular statistics about remortgages

- Doing five hundred,000 remortgages in britain every year

- Around 50% is actually security taken mortgages and you may fifty% was refinancing mortgage loans

- Source claim that remortgaging effortlessly is going to save people ?3,000 to help you ?4,five-hundred a-year

Why would We remortgage my personal domestic?

- Save money by accessing straight down mortgage pricing

- Which have a top income and a better credit rating, you might be qualified to receive finest rates

- You could borrow funds up against your property

If you’re looking into remortgaging your home, you could find that you may possibly conserve numerous or tens of thousands of lbs annually on the mortgage payments.

While caught to the a predetermined rate mortgage or the fundamental varying price and possibly now discover lower rates available, there is certainly a substitute for switch to a special financial contract or remortgage’ to get into best pricing. Also, which have a much better credit rating and higher friends income, this could give you eligible for lower prices.

Example: Swinging out of a good 5% home loan from the ?175,000 so you can a speed regarding 3% carry out save yourself up to ?180 four weeks, equal to ?2,160 a year

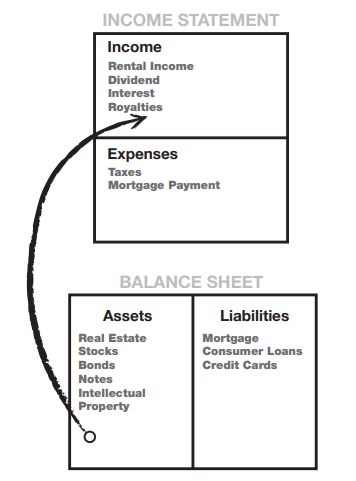

Not only can you generate a monthly preserving, but you can and release specific collateral from your home for the greatest or borrow money against your property. Should it be for debt consolidation reduction, spending money on school charges, wedding events or other expenses, you could mark off a massive share and costs are set in your own monthly home loan repayments.

Example: If you have a property worthy of ?three hundred,000 and you will a mortgage value ?2 hundred,000, you might improve an extra ?twenty-five,000 and make your own home loan repayments worth ?225,000

With credit amounts ranging from ?ten,000 in order to ?250,000 (or more), the amount you might acquire when you remortgage depends on the numerous items including your:

Borrowing from the bank money against you reside often called secured loans, second costs mortgages or just, next mortgage loans. You could potentially use to 80% or ninety% LTV towards the a second charges home loan with respect to the financial.

Just how much can i save your self when i remortgage?

Studies suggests that the common homeowner can save around ?step 3,000 to ?cuatro,five-hundred annually whenever swinging out of a fundamental varying rate (SVR) to a different home loan manage a reduced rate.

Am i going to constantly spend less whenever i remortgage?

Zero, you do not usually save money should you get a beneficial remortgage, this is the reason you will need to work with the fresh new amounts ahead.

If you are searching to end your current mortgage bargain very early, you might be necessary to shell out an earlier cost charges (ERC) between step 1% so you’re able to 5%. So it charges should exceed the possibility offers you earn regarding another type of financial offer.

Concurrently, payday loan Cathedral you may have to remortgage because your past home loan happens to be going to an-end. But if you was basically destroyed money, possess a bad credit rating than ever or perhaps the market is perhaps not offering competitive costs, you may find on your own using more your own brand new financial.

Exactly what are the downsides from remortgaging?

It is usually crucial that you be aware of any possible cons. If you’re looking to increase cash on most readily useful of your own home loan, this will improve size of their home loan and maybe increase the mortgage repayments as well.

If you are looking so you can obtain amounts from ?10,000 otherwise ?20,000, there may be cheaper selection thru 0% playing cards or personal loans, if you really have good credit.

You need to be careful when adding loans into financial just like the dropping trailing towards the costs could put your household at risk away from repossession.