After you purchase property, the home loan company may wish to discover whether the house your are to shop for deserves what kind of cash you may have concurred to invest. The lending company must gauge the domestic and find out something that you are going to negatively or certainly change the home’s fair market value. To this page choose a beneficial house’s well worth, lenders want house appraisals for everybody borrowers.

Federal banking legislation wanted that the bank order the fresh new assessment. The newest laws and regulations is actually a result of new deals and you can financing scandals in the late eighties. F ederal legislation entitles you to receive a duplicate of one’s assessment from your own bank.

Listed here are five common questions Massachusetts earliest-big date homebuyers find out about real estate appraisals in addition to approaches to the individuals questions.

What is a property Assessment?

A bona-fide property assessment sometimes described as a house assessment, are a quote away from good property’s well worth. Value of is based on such as things while the venue, features, structural condition, rectangular video footage, level of rooms, quantity of restrooms, and you will present conversion process from equivalent close qualities. Appraisals is held getting single-family residential property, condos, and you may multi-equipment dwellings. An appraisal is not a property evaluation.

An authorized appraiser conducts the real home appraisal. The latest appraiser will perform a walk-as a consequence of of the property, listing anything that you will replace the house’s worth. Brand new appraiser tend to outline out the floor plan for the house, just take photographs of the property to see one shelter abuses. When the you will find such violations, the issues may need to feel fixed through to the bank approves the loan. The kind of mortgage either identifies if or not an issue has to become corrected. Including, FHA and you will Virtual assistant money possess book requirements.

Just who Work Real estate Appraisals in Massachusetts?

Appraisers into the Massachusetts try signed up. Authorized appraisers was ruled by regulations and you will laws and regulations, and they has to take accepted courses and an examination to track down the licenses and continuing studies to maintain their license. New role of your appraiser would be to promote an objective, unprejudiced and you will objective view concerning worth of our home he otherwise this lady has appraised. The brand new appraiser’s viewpoint might possibly be your appraised property value the newest house is lower than the assented-upon offer price. Get a hold of Appraisal Gap Clause.

Whom Will pay for A house Appraisals?

Most loan providers commonly gather the price of the assessment regarding homebuyer upfront. Even if the appraiser’s payment is not accumulated beforehand, the cost would be died into homebuyer while the a closing prices for some loan programs. Appraisals usually rates ranging from $375 and you can $five-hundred, but appraisers have a tendency to charges additional fees if they need to make multiple visits to the property unconditionally. Loan providers need divulge assessment or other charges in the Loan Guess, that’s a good three-web page form one to prospective consumers discover after applying for a home loan.

Whenever Really does an appraisal Take place?

Usually the home loan company commands the fresh new appraisal the moment it gets the signed purchase and you may sales agreement in the Massachusetts. Either the situation necessitates the financial to shop for the fresh new assessment fundamentally. For the Massachusetts, it is important that the homebuyer get an acceptable assessment prior into the financing relationship time.

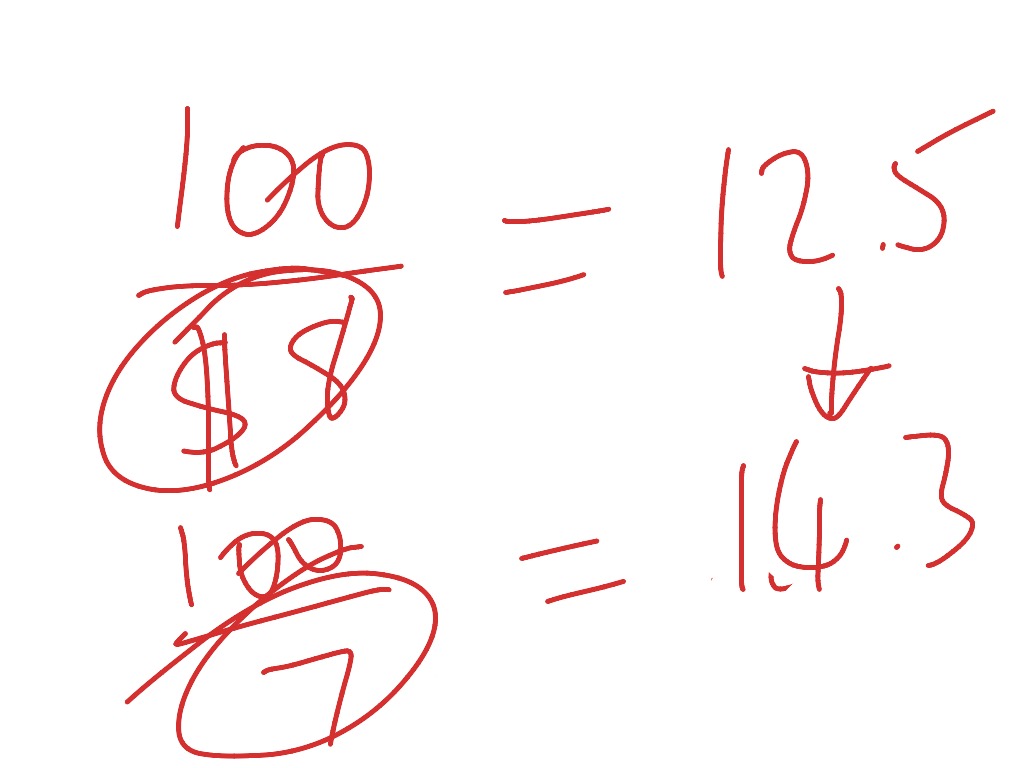

In the event that from the opinion of one’s appraiser new residence’s worthy of was below the latest decided-upon cost, the fresh new homebuyer’s financing would be at risk. Both the financial institution often refute the mortgage or will require new homebuyer to improve the amount of its deposit from the difference between the fresh new consented-abreast of rate in addition to down appraisal worth. If your homebuyer doesn’t have the latest readily available bucks to increase the level of the brand new advance payment, the buyer will have to terminate the transaction through to the financing union due date.