Share this short article

BOSTON , /PRNewswire/ — Two years after its historical financial settlement agreement toward U.S. Agencies of Justice and half dozen states, Bank from America keeps conditionally found more 91 % regarding the responsibility to add $eight million value of consumer rescue, Eric D. Eco-friendly , separate Screen of contract, said today.

Teacher Eco-friendly, inside the sixth summary of Bank of America’s efficiency according to the , payment contract, mentioned that to your basic one-fourth off 2016, the lending company recorded requests and Monitor with his elite group professionals conditionally approved a supplementary $1,930,647,000 regarding individual-recovery borrowing from the bank.

Monitor: Financial regarding The united states Closes from inside the on User-Save Address

Of that amount, over $step 1.7 billion is to possess changes so you’re able to 64,072 mortgage loans, leading them to more affordable. More $114 billion of requested borrowing related to people reinvestment and you may neighborhood stabilization in the way of mortgage loans, a property and money that lender contributed in order to municipalities, home financial institutions, Society Invention Loan providers, non-earnings or other entities. A different almost $54 million are having extending new finance so you’re able to 5,336 low- and you will moderate-money first-big date homeowners, consumers during the Most quick business loans Wisconsin difficult Hit Section or consumers exactly who forgotten their homes inside foreclosure otherwise quick conversion process. (Hardest Strike Elements was census tracts acknowledged by the newest U.S. Institution from Housing and Urban Advancement as the with highest concentrations regarding troubled properties and you may foreclosures circumstances.)

Also early in the day submissions, the amount of credit conditionally confirmed totals $six,370,587,939 , otherwise 91 percent of one’s $7-billion responsibility. This new recognition is actually topic, at close of your own bank’s individual-rescue factors, towards the Monitor’s latest determination and qualification that the bank’s efforts adhere to most of the conditions of your own payment contract.

- Mortgage variations to boost value – $5.twenty seven billion (82.8%)

- Loss-while making money to support reasonable reasonable-money rental construction – $442 billion (6.9%)

- New house funds in order to reduced- and you may modest-earnings consumers – $346 billion (5.4%)

- Donations to help you municipalities and low-profit organizations to advertise society reinvestment and you can community stabilizing – $308 mil (4.8%)

This new cumulative credit complete cannot yet become enhancements that the lender can be entitled to underneath the agreement if the, at the conclusion of its user-rescue issues, the bank meets certain extra targets it is currently to the track going to.

“If Lender regarding The usa keeps its current speed in the providing individual rescue, it does see their personal debt underneath the Settlement Contract this present year, really ahead of the four-season deadline,” Professor Eco-friendly told you.

An individual recovery seems to be supposed in which the repaying events created, he added. Regarding 53 per cent of all mortgage improvement examined yet possess been in Most difficult Strike Parts, with most them targeted at funds protected otherwise insured because of the Virtual assistant or FHA. Financing modifications and you will this new finance was in fact brought broadly, to every county and also the Region out-of Columbia , and also to 107,669 census reduces. More 5,000 reasonable rental property systems 68 % to own Important You want Household members Houses is supported by 44 subordinated loans made confused to the bank.

To start with, according to Professor Eco-friendly, the info demonstrate that variations to possess basic-lien dominant decrease the most significant piece of required user rescue are somewhat decreasing the financial load on the readers. The typical principal reduction with the variations assessed up to now is much more than just fifty percent, the average mortgage-to-value ratio enjoys dropped away from 176 percent in order to 75 percent, the typical interest rate has been slashed away from 5.38% in order to 2.10%, and you can, critically, an average monthly payment has been quicker from the $600 30 days-almost 38 per cent.

“The newest rescue getting provided below that it arrangement in person and you will materially support residents unable to afford to stay static in their houses,” Professor Environmentally friendly told you.

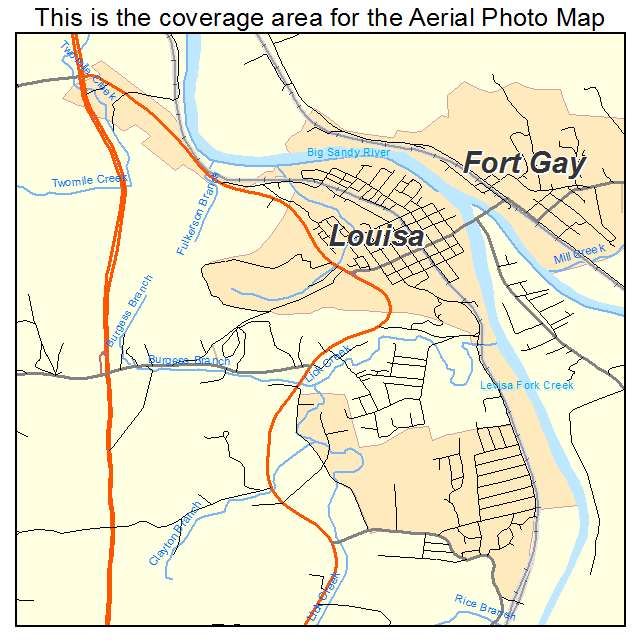

The August 31 statement and you will an entertaining map arrive from the the fresh Monitor’s site from the: This site provides subsequent factual statements about the settlement, email address to have Bank out-of The united states, the fresh new DOJ, the brand new attorneys standard of your own half a dozen playing says, HUD, Federal national mortgage association, Freddie Mac computer together with Economic Ripoff Administration Task Push, along with information about clinics for property owners who require recommendations but perform perhaps not understand where to get they or cannot afford they.

The brand new Monitor’s emailing address was: Display screen of your Lender from The usa Mortgage Settlement, P.O. Field 10134, Dublin, OH 43017-3134, together with e-send target is [email address secure] .