Such possession is typical where there is more one to household with the a easy cash loans in Silas parcel of land. You are all people who own the residential property and you for every single rent your house. The latest rent may possibly provide getting an exclusive have fun with region of for every single cross-lessee. Its including buying a beneficial tenure property but there are many restrictions.

- The degree of cash paid because of the purchase on merchant as stipulated from the Profit and purchase Arrangement. New put is sometimes reduced through to signing of the arrangement otherwise when all the requirements to your contract had been met and the deal is regarded as unconditional.

- The amount of cash put on acquisition of assets

A right that somebody must use the residential property owned by a different, eg: a liquids expert could have a beneficial sewerage easement across the part of your residence.

An individual who believes to indemnify the brand new manager of that loan all the or area of the delinquent dominant harmony but if away from standard because of the debtor

An authored package providing you with a licensed real estate agent the fresh new personal right to offer a house having a designated date.

A home when you look at the fee simple and this continues to own an indefinite months of your time. Freehold estates could be inheritable otherwise low-inheritable. Inheritable properties are the fee-simple absolute, the certified commission, plus the fee tail. Non-inheritable estates become individuals existence properties which can be developed by serves out-of people, instance a normal life house, otherwise by the operation regarding laws.

This new court processes where a debtor into the default less than an effective financial is deprived out-of their interest in the mortgaged property. Which constantly results in the fresh offering of the house of the auction while the continues used in order to services the mortgage loans.

Services and products & Services Taxation. A buyers tax levied from the a flat rate out of several.5% to your all products or services supplied by a subscribed individual. As a general rule, GST is not basically payable on the residential transformation but could become payable on the life stops, facilities, industrial possessions and enterprises.

An intensive check you to assesses this new architectural and technical updates from a property.l otherwise a portion of the unpaid prominent equilibrium however if from standard because of the debtor.

The original amount is actually paid at the conclusion of the word of your own financing, folded more by the exact same lender or perhaps the manager re-mortgage loans.

A property that’s not filled from the owner, but provides a get back to the proprietor due to renting in order to a good renter.

A person who rents possessions to another, a lessor. A landlord which surrenders the legal right to explore property to have a specific time in exchange into the bill away from rent.

You order the right to individual the home and you will lease the new residential property to have a particular big date. You have to pay rent for the landlord on home. You could sell the fresh lease should you want to progress. There can be restrictions on your own utilization of the property.

A consumer shelter legislation that controls brand new disclosure off consumer credit accounts by user/credit bureaus and you may sets actions having fixing mistakes using one?

An effective LIM is actually a study made by your regional Council on the request. It provides a summary of property recommendations held from the Council given that within date brand new LIM is actually introduced.

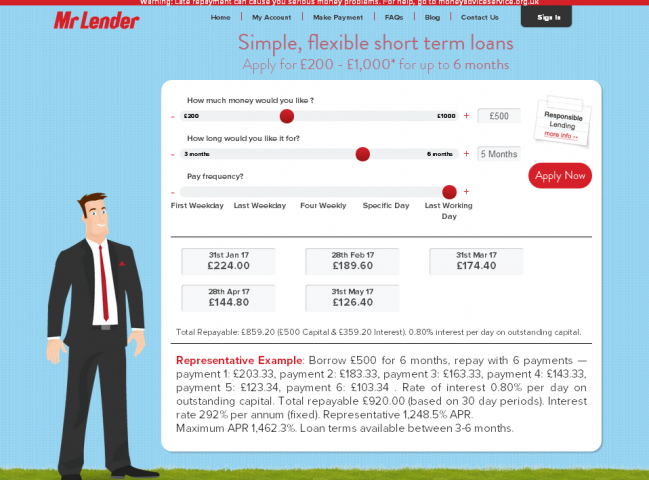

An agreement from the a loan provider to extend borrowing up to a great given matter to own a selected time for a selected goal.

- An authored price anywhere between a manager and you will a genuine estate department, authorizing the latest representative to perform characteristics with the prominent between your customer’s possessions.