As to the reasons Realty

Consider anybody guaranteeing simple and fast selection. They could be considered your click this over here now to possess an alternative type of financing, but pay close attention to the expenses inside it plus don’t throw in the towel toward temptation to get the original financing only because you will be recognized.

Getting your software rejected is usually a distressing surprise, but with some time and effort, you will probably have the ability to handle the problems one was the cause of denial. It is important to understand that the mortgage assertion ensures that the financial institution is not able to agree the application towards the activities he’s got currently time. Most loan providers – if not completely – aspire to ensure you get your business if the just in case the issues keeps started addressed.

Find out the appropriate reasons

In case your loan application is actually denied, try to influence as to why, and then take steps to correct one issues otherwise improve your capacity to score a home loan later.

Come back and communicate with the loan officer to determine the particular reason why their request was denied. You will be in a position to encourage your own lender to help you reconsider that thought the app. If you don’t, require suggestions on what you can change your ability to locate home financing. On the other hand, never necessarily assume that a getting rejected by you to bank ensures that most other loan providers would refute the loan app.

Decreased financing You might shoot for the vendor so you can agree to invest in one minute mortgage , and so reducing the number of advance payment necessary. Or, maybe a member of family will be happy to render something special off financing for use during the paying the closing costs . Have there been downpayment or closure rates direction programs accessible to you? If all else fails, initiate a critical offers package you will be in a great finest condition to order property when you look at the per year or one or two out of today.

Lack of money When your lender’s qualifying formula signifies that you simply cannot spend the money for family youre suggesting to acquire, possibly you will find several extenuating products that you may possibly suggest with the mortgage manager. Such, is the book youre currently spending to the fresh advised payment per month? Could you be owed to own an increase, which could leave you qualified to receive the mortgage? Perform a letter from the boss let?

Continuously financial obligation Perhaps your current obligations is actually what’s creating new roadblock, because it leaves your beyond your lender’s qualifying direction. Once more, if you find yourself most close to qualifying, you might be able to persuade the financial institution so you can think again, particularly if you has actually a good credit history. Or even, you might have to pay-off the your debts ahead of you can get a home. Otherwise, just, choose a less costly household.

Less than perfect credit get If you find yourself denied borrowing with the base of a card agency statement, youre entitled to a no cost content of report regarding the credit revealing service itself. Then you can difficulties people problems and can along with believe you to the financing revealing company are the edge of one unsolved borrowing issues that it account. Should your credit history are deficient in some way, you really need to begin paying down expense to have most recent. After you have enhanced their borrowing reputation, you’re able to initiate house bing search once more. If you have removed a loan playing with a non-traditional credit rating that documents repayments in order to landlords and you may electricity enterprises, it’s also possible to inquire a non-profit homes service or mortgage therapist in order to present brand new documents inside the a favorable white.

Lower assessment Possibly the loan app was refused due to the fact appraisal of the house is as well reduced versus agreed-up on rates. You are able to utilize the lower assessment to assist you renegotiate the purchase price towards the merchant to help you an amount the lending company manage commit to finance. When your lowest appraisal shows certain architectural trouble or any other called for solutions, see if you can obtain the manager to invest in augment the challenge till the marketing. Perhaps the bank tend to agree your loan demand in case the vendor believes to create aside fund during the an enthusiastic escrow membership getting used to result in the needed fixes pursuing the business.

Seek outside assist Once you understand exactly what brought about the application denial, you could potentially generate an authentic propose to succeed on the future. Take a look at the one state and you will local software designed to encourage homeownership, including personal and you will low-cash businesses. Is the household we need to pick from inside the a metropolitan revival urban area? If so, around that will help you financing you buy.

Look at the alternative capital plans

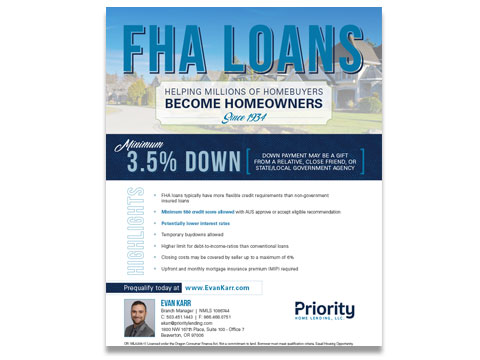

Once we talked about right here, if you are a low- so you can reasonable-income home buyer, you need to consider one or more of one’s financial products built to let home buyers out-of more compact function receive affordable housing. This type of alternative points will get let you defeat some traditional traps to help you homeownership, such as decreased finance to have an advance payment otherwise closing costs , having no founded credit rating, or which have home expenditures that will be greater than elements generally let for the mortgage credit.

- Fannie Mae’s and you can Freddie Mac’s Community Lending Programs

- Backed next home loan

- Lease-purchase home loan

- Neighborhood do it yourself real estate loan

- Society house believe mortgage

- Homes loans company software

Consider non-conforming, otherwise subprime, loans If your credit has brought about the loan become refuted, it’s also possible to think a low-conforming , or subprime loan. Good subprime financial will cost you a top rate of interest and even more points, to offset the additional chance your perspective because of your borrowing from the bank records. Costs are very different a great deal anywhere between subprime loan providers, so it’s particularly important which you evaluate lenders when choosing when planning on taking such as for example financing.

Within the deciding whether or not you should take an effective subprime mortgage, consider the expense and you may benefits. Can it seem sensible to pay a whole lot more today with respect to high notice and you may products as opposed to trying to improve your credit and you will monetary administration models. You can then submit an application for a “prime” mortgage after, in the a reduced speed and you can affairs. Of many consumers go into subprime financing towards aim of refinancing in order to a less costly mortgage afterwards, shortly after their credit rating advances. If you plan to accomplish this, shell out version of awareness of if such as for instance that loan enjoys a good pre-fee penalty , since this perform put more will cost you if while you be considered to have a cheaper loan.