Opposite mortgage loans is a financial merchandise that of many property owners thought because they ages, providing a chance to make use of their residence equity with out to sell or escape.

Whenever you are taking out a face-to-face financial is good for residents who are battling economically, it does do challenge towards homeowner’s heirs once their dying. That’s because heirs which inherit a house which have an opposite mortgage do not just inherit the property. However they inherit the responsibility to invest right back the mortgage.

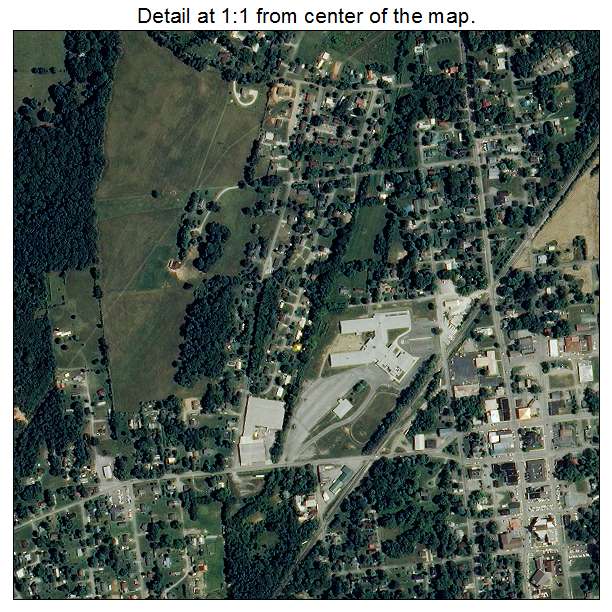

At the Russell Manning Attorney, We let homeowners to-do its estate believed goals if they have a face-to-face home loan (otherwise are planning on one) as well as the heirs of them exactly who passed away which have a reverse home loan to their possessions. My personal law firms is actually situated in Corpus Christi, Colorado, but We serve clients on Coastal Fold Urban area and you will Southern Texas.

What’s a contrary Financial?

An opposite financial is a kind of mortgage offered to people that happen to be normally 62 decades otherwise old, letting them borrow money using their house security and convert it into the bucks. A contrary financial is the contrary of a traditional home loan (and therefore the name) since it is the lender which will pay the resident, not vice versa. However, the loan should be repaid if the residence is offered or the fresh debtor motions away permanently or dies.

Most reverse mortgages in the us are domestic collateral transformation mortgages (HECMs) available so you can people by way of lenders authorized by the Government Houses Administration (FHA).

Just how an other Mortgage Impacts a wife otherwise Partner once they Are a great Co-Borrower

Should your enduring companion or mate is actually a great co-debtor into the reverse home loan, the situation pursuing the borrower’s demise may be so much more easy. Because a good co-debtor, the brand new enduring lover or lover have equivalent liberties and responsibilities away from the loan:

Proceeded house. The brand new enduring co-debtor is continue located in your house without the need to pay off the mortgage quickly. The opposite home loan simply become due in the event that past thriving co-debtor becomes deceased, offers your house, or movements away forever.

Use of funds. New surviving co-borrower continues to have access to any kept money from the reverse mortgage, with respect to the modern terms and conditions.

Duty. The newest co-borrower need to continue steadily to meet with the financial obligation of your financing, for example paying property fees, home insurance, and maintaining our home.

When a borrower which have a face-to-face home loan dies and you also will be the surviving co-debtor, you need to alert the financial institution of your borrower’s dying right that one may. This may start the whole process of deciding the newest loan’s reputation and 2nd measures.

Exactly how an opposite Mortgage Has an effect on a spouse or Companion when they Commonly a good Co-Debtor

The challenge grows more complicated in the event that a spouse otherwise spouse was maybe not a good co-borrower to the reverse financial. In such a case, the latest surviving lover otherwise mate could possibly get deal with some other challenges and you will choice.

Through to the fresh new loss of brand new debtor, the reverse mortgage gets due and you may payable so long as here is not any other surviving co-borrower. It indicates the mortgage have to be paid down, usually in one single to help you half a year, even though extensions may be you can. The newest surviving spouse otherwise lover could have several options to have paying the loan:

Offer your house. If the deals is done, the brand new partner otherwise companion are able to use the newest continues to pay straight back the reverse mortgage. Any left equity after payment is one of the surviving partner or partner.

Refinance. If the qualified, the new enduring companion or mate is also refinance the reverse mortgage on the a timeless mortgage otherwise a special reverse financial within their identity.

Pay off the loan. If available, the brand new surviving lover or partner may use most other possessions to invest off the contrary financial equilibrium.

In case your thriving spouse otherwise partner isnt into term, heirs (eg students) may also have the possibility to repay the borrowed funds and keep the home. Specific contrary mortgages are provisions to safeguard non-credit partners, permitting them to stay-in the home following borrower’s passing. These types of protections vary by the loan method of and you will financial, so if your lady otherwise mate died that have an opposite financial you might keeps a legal professional remark this terms of financial.

Methods for Property owners with Contrary Mortgages

If you have an other mortgage otherwise are considering one to, here are some tips to simply help verify it aligns with your long-title requires:

Keep in touch with your family. Of many home owners whom propose to remove a contrary mortgage do perhaps not communicate with their family participants about this. Oftentimes, family unit members and you may heirs know nothing on a face-to-face financial up to pursuing the homeowner’s passing. If you, given that a homeowner, safely share your choice discover a reverse mortgage, you could avoid dilemma and you can issues in the long run.

Designate people you trust as executor. This new appointment regarding a keen executor to suit your estate is a vital step no matter whether you have an opposite home loan or otherwise not. If you, the brand new executor will be responsible for managing the repayment procedure and you can communicating with the lender.

Maintain your records arranged. A very important thing can be done are take care of organized records away from their opposite home loan records, including statements, agreements, and make contact with suggestions to your bank. This makes it more relaxing for your heirs understand the newest regards to the opposite financial and you can carry out the latest payment techniques.

Speak with an attorney. With a face-to-face home loan can result in certain dilemmas for your property bundle. This is exactly why you might want to seek brand new suggestions out of legal counsel when you take away an opposite home loan otherwise setting up a home plan that have a reverse home loan. The lawyer will help ensure that your contrary financial doesn’t pose a risk to your house ownership, nor does it carry out stresses for the heirs regarding the unfortunate enjoy of dying.

If you are a resident that inquiries of a contrary home loan concerning the home planning, you might want to have the assistance of legal counsel.

Mention Your position that have legal counsel

Because a house think attorneys, I understand just how an opposing financial are included in an enthusiastic property bundle as well as how they affects heirs when a citizen seats out. While you are a resident given taking out a reverse financial on your own house, I could help.

On Russell Manning Lawyer, I also help people who inherit a house with https://elitecashadvance.com/payday-loans-ca/san-diego/ a reverse financial and need let determining what to do throughout the a beneficial duration of grief. Label my place of work today to agenda an incident comparison.