Specific loan servicers (the company where you upload your own commission) give you wait a few years to terminate PMI, in the event you’ve paid off so you’re able to loan down otherwise their residence’s value has gone right up. You might have to spend a lot of money getting an alternative assessment or even thousands of dollars to the a beneficial re-finance so you’re able to terminate PMI.

So if you’re taking a massive extra of working, a heredity, cashing inside investment, or attempting to sell an earlier house in the near future, you will need the new 80-10-ten choice so you’re able to pay-off the second loan and you can dispose of the fee, zero concerns expected.

80-10-10 disadvantages

Need good credit: The next mortgage normally needs most useful borrowing from the bank as compared to number one financial. Anytime their credit has many blemishes, you I.

Qualify for two mortgages: You should be eligible for several sets of loan guidance, not one. Next home loan constantly arises from yet another lender which could have different statutes for the financing.

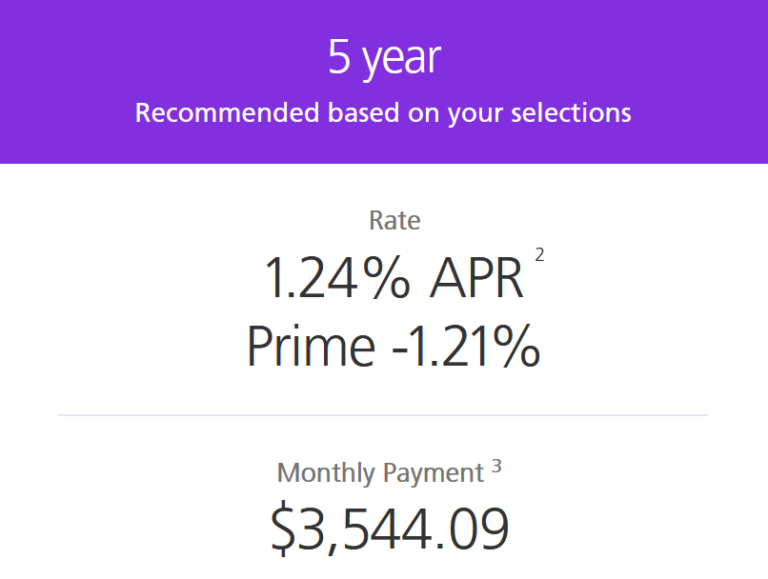

Varying price next financial: The following financial will in all probability come with an adjustable rate one to is founded on the present day perfect rate. From inside the a growing rate environment particularly the present, the second mortgage price could possibly get https://www.paydayloanalabama.com/mckenzie go up. However, the fresh fee don’t end up being unmanageable while the mortgage try for ten% of the home price. You might nevertheless get a predetermined-rates financial on the 80% piece.

Parallel closure: Ensure that your bank has experience in closing piggyback fund. They should do a twin closure. Both the prie big date, or you buy would-be delayed.

One or two independent payments: Might shell out a couple of costs per month to split up loan providers. In the present on the web financial automobile-pay world, that is not a big deal. Only install continual costs.

Qualifying having an enthusiastic 80-10-ten piggyback mortgage is a little more complicated compared to a standard conforming financial. That is because another mortgage is considered greater risk, thus has high prices and much more strict approval standards.

And you may, even although you get approved toward primary financial, there is a go the second home loan company wouldn’t undertake the application.

The minimum credit history to have a primary antique financial is actually 620, while some mortgage lenders need an even higher score. Although second home loan company may require an effective 680, 700, otherwise higher.

Lenders will additionally look at your DTI. When you yourself have extreme low-construction bills, eg higher bank card balance, an automible payment, and you will a fantastic unsecured loans, they could see you once the highest-risk by the addition of into the a couple of construction funds on the other hand loans heap.

Piggyback finance versus FHA against Traditional that have PMI

Less than was a rough research of your own around three financing types discussed. Click on this link to track down a personalized quote per solution.

$300k Household Purchase80-10-1090% FHA90% Conv. w/PMIFirst mortgage$240,000$274,725 (incl. upfront FHA MIP)$270,000Second financial$29,000n/an/aHas financial insurance?NoYesYesHas second mortgage repayment?YesNoNoThese numbers is estimates as well as for analogy motives simply.

80-10-ten choices

If an 80-10-ten piggyback loan is not an option for you, there are more an approach to rescue. So there are a number of zero and you may low-down percentage mortgage programs one, as they perform possess some sort of financial insurance policies, is the proper financial movements in any event.

A normal 97 financing, by way of example, allows eligible homeowners to get property with 3% off. The fresh 97 makes reference to the loan-to-value proportion (LTV): 97% borrowed and you will step three% down.

Might shell out PMI towards the a traditional 97 loan. However, on the other hand, it could be better to be eligible for one among them financing compared to a keen 80-10-ten piggyback financing, especially if you keeps a great although not sophisticated borrowing from the bank or their DTI is found on the higher end.